Credit insurance contract

Credit Insurance Object

- Accounts receivable with payment terms of up to 180 days

(exceptionally up to 360 days)

Insured Risks

- Clients’ defaults due to insolvency proceedings

- Clients’ defaults due to protracted payments

Credit Limits

An important element of credit insurance relationship between an insurance company and the insured company is credit limit setting. The credit insurance company credit checks (larger) clients of the company and sets the credit limits. The credit limit is the maximal exposure that the credit insurance company provides cover for, and is determined by the value and dynamics of deliveries of goods/performing of services, payment terms, usual expected (tolerable) late payment period, and currency of deliveries.

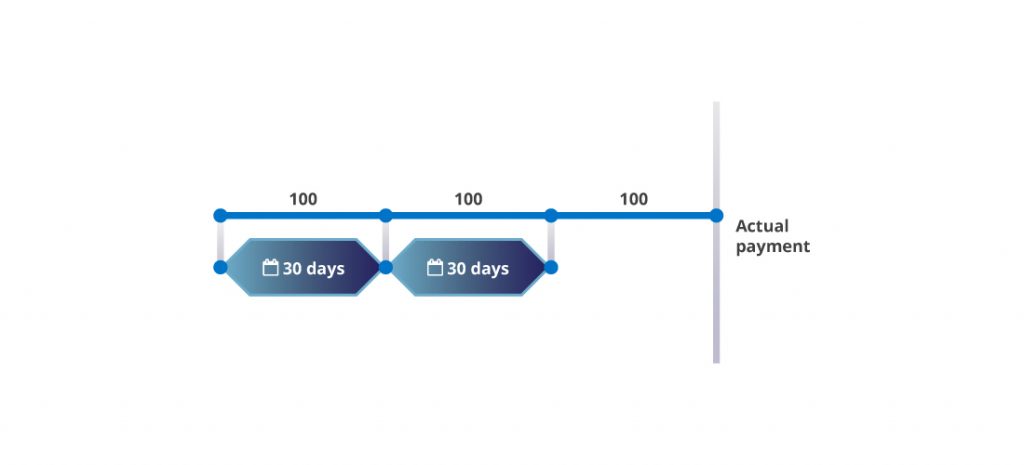

EXAMPLE: Expected sales of EUR 100.000 per month with constant dynamics throughout the year.

In cases when the credit insurance company cannot extend credit insurance coverage for some buyers due to insufficient credit rating, we help our clients to shape a cooperation strategy towards such buyers, whereby we use all available legal means (i.e. alternative techniques of managing credit risk).

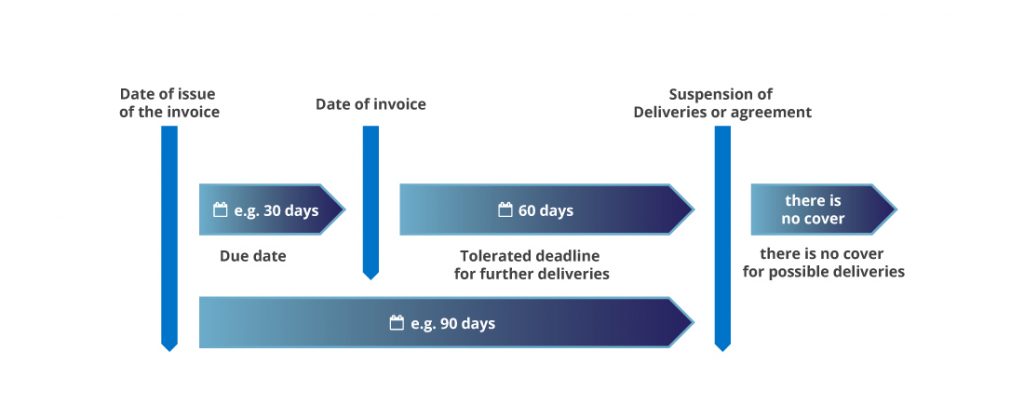

Suspension of deliveries and dunning

Two important features of a credit insurance contract that help strengthen processes and procedures are suspension of deliveries and dunning. Suspension of deliveries must be activated after 30 days after payment terms. If this is not the case, exposure of an insured company to the client increases (most probably above the set credit limit) and the credit insurance company declines to offer cover. Exemptions to this general rule are possible with the active agreement between the insured company and its debtor, and with the consent of an insurance company.

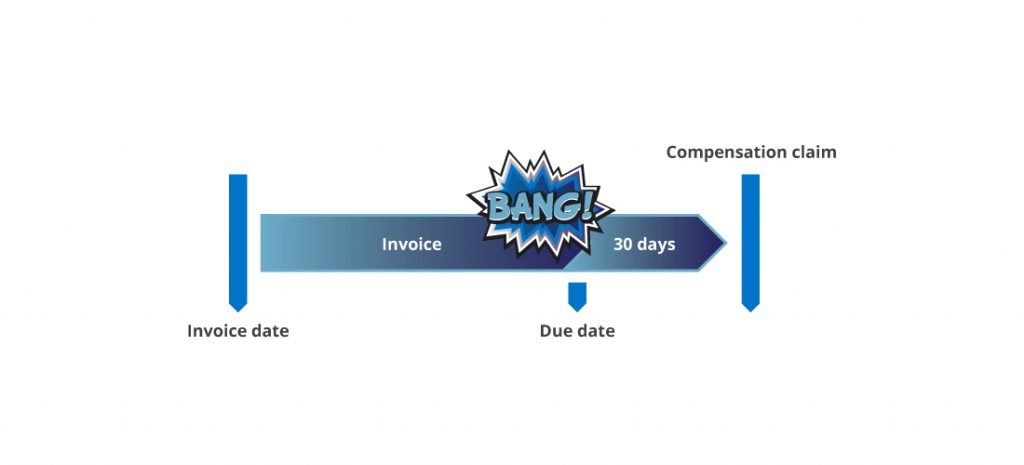

For all the cases where clients do not pay on a due date, company staff resorts to internal dunning (written or oral payment reminders, personal meetings, meeting agreements), which can also be performed with the help of the credit insurance company (communication from a credit insurance company to the client, etc.). If internal procedures are insufficient and do not result in the client’s payments within the determined period after the invoice due date, the insured company has to use the services of external professional dunning/debt-collection agencies or lawyers. In case of a default of the client, costs of external dunning are covered by a credit insurance company.

Indemnification

Indemnification by a credit insurance company is done

immediately after an insolvency procedure is announced, or in the case of protracted payments cover, after some period after the invoice due date and involvement of an external dunning/debt-collection agency.

SAMPLE: Protracted payment