Energy costs and inflation have been widely discussed in the business world recently. Both have reached levels that seemed unprecedented a few years ago. Data shows that households and businesses were both impacted by rising energy costs. In this article, we will explore how energy prices and inflation will continue to persist throughout 2023. We will analyze their past performance and present the factors driving their movement. We will also provide our predictions on how these two factors, along with others, will impact businesses in the future.

1. Energy Costs

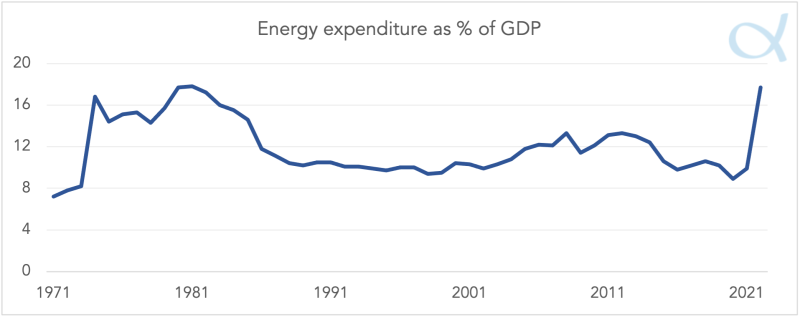

Since the Russian invasion of Ukraine, Europe and the world have been challenged by an energy shock not seen since the 1970s. According to data compiled by the OECD (2022), the world economy spent an estimated 17.7% of its GDP solely on energy in 2022. In comparison, the average percentage of GDP spent on energy per year in the period from 2000 to 2021 was 11.2%. As a result, the increase of the world energy bill in 2022 was nearly 60%, compared to its average throughout the 2000s.

Source: OECD Economic Outlook (2022)

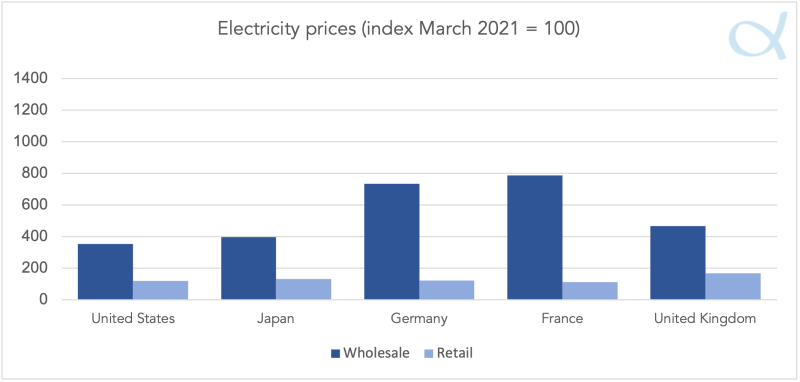

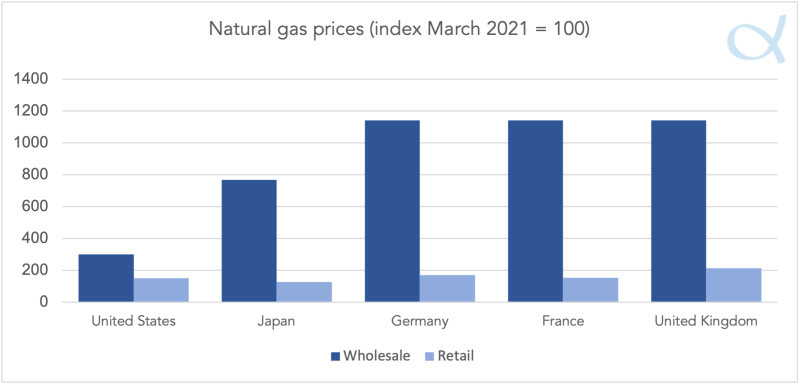

Increasing energy costs are damaging the world economy, especially when it comes to wholesale electricity and gas prices. The difference in wholesale and retail prices can be observed from the figure below. Differences in growth between wholesale and retail prices can mostly be attributed to government interventions aimed at shielding households from soaring energy prices. European countries were impacted the most among their peers within the OECD.

Source: Refinitiv; U.S. Bureau of Economic Analysis; Statistics Japan; Eurostat; U.S. Energy Information Administration; Japanese Power; and OECD calculations.

Source: Refinitiv; U.S. Bureau of Economic Analysis; Statistics Japan; Eurostat; U.S. Energy Information Administration; Japanese Power; and OECD calculations.

The future of energy prices is uncertain. We can expect significant market volatility. As we enter 2023, gas and electricity prices are falling (see the correlation between the two in our previous article) in Europe due to a mild winter across the region and a high level of stored reserves. According to ING (2022), European gas reserves were 96% full in mid-November of last year, which is a 9 ppt increase based on the five-year average. However, winter is far from over. The bigger question is how the European countries will replenish their gas storage throughout 2023. ING (2022) also reports that Russian gas flows to Europe are down 80% year-over-year. Given the geopolitical tensions, it is possible that the flow between the two will cease entirely.

2. Inflation

The Harmonized Index of Consumer Prices (HICP), used by the European Central Bank (ECB) to measure price stability, is projected to average 8.4% in 2022 by the ECB. The bank predicts that inflation will gradually reach its target of 2% in 2025. Inflation, which was argued to be temporary by the central bankers, has proven to be permanent. We argue that the two most important pillars driving HICP are historically low borrowing costs and, as previously discussed, steep increases in energy prices.

The first pillar is managed by the ECB, with significant increases in interest rates in the Eurozone. These increases have led to a decline in the European housing market, according to Bloomberg (2023), particularly in Denmark, where real estate prices dropped 15% below their peak in March 2022. We expect interest rate hikes to also impact the business sector by slowing down investment expenditure.

It is difficult to predict the dynamics of energy prices throughout 2023. From a global perspective, we may see significant volatility depending on how China manages the COVID pandemic. Currently, oil prices are gradually decreasing from their peaks in 2022 due to low demand from China because of strict COVID measures in place. If China opens its economy, we can expect a sharp increase in the oil market. Europe’s natural gas pain may be alleviated by importing liquefied natural gas (LNG). However, LNG imports and storage require significant infrastructure that Europe currently lacks. Due to the scarcity of alternative gas sources, we expect gas prices in the EU to reach new highs throughout the second year of 2023 when Europe will be preparing for winter.

3. Conclusion

High energy prices, rising borrowing costs, peak inflation, and extreme uncertainty are indicating that the European Union is heading towards a recession. According to the ECB (2022), the Eurozone will enter a slight recession in the fourth quarter of 2022 and will remain in the negative zone in 2023. Households will likely allocate more and more of their income to cover higher living costs. Businesses, particularly production, will have difficulty managing energy market volatility and higher borrowing costs. Additionally, the real sector is expected to face a fall in demand, which can lead to lower output and labor force rationing. As this cycle unfolds, we predict that the Eurozone might reach its target inflation rate of 2% in the next couple of years. Should central banks and policymakers begin to initiate a more stimulative fiscal and monetary environment, we might face another upward tick in inflation.

Lastly, we expect an increase in credit risk in the business environment. Insolvency cases are gradually growing, and with higher borrowing costs, coupled with unhedged electricity or gas positions, some companies might go out of business this year. Hopefully, no other major shocks will occur across supply chains. Energy-intensive supply chains will remain the primary concern.

This article was written by the team at ALPHA CREDO

Sources:

OECD (2022). OECD Economic Outlook, Volume 2022 Issue 2, OECD Publishing, Paris.

ING (2022, December 20). Energy outlook 2023: Oil, gas, and power markets to remain tight by Warren Patterson and Gerben Hieminga. Retrieved January 12, 2023, from here.

Bloomberg (2023). What’s Causing the Swedish Housing Market Plunge by Niclas Rolander. Retrieved January 12, 2023, from here.

ECB (2022). Eurosystem staff macroeconomic projections for the euro area, December 2022. Retrieved on January 12, 2023, from here.