The European Union is highly dependent on the influx of energy resources from Russia. Be it petroleum, crude oil or natural gas, Russia is the partner the EU relies the most on. Since the beginning of the war in Ukraine relationship between the two nations deteriorated swiftly. As a result, the EU’s energy markets have recorded historically high prices ever since. Pain is being felt by all participants in the market – households, companies, and energy companies as well. Leaders of the EU have for decades neglected the basic principle of diversification when building energy strategy. Undiversified sources cannot be reversed overnight, which leaves countries vulnerable in case major energy sources dries up. Such potential threat was discounted on the premise that economic cooperation will always win over geopolitics. This turned out to be a miscalculation. The second error is the merit order mechanism, implemented to set lower average electricity market prices with the introduction of renewable energy sources, which proved to be a not-so-optimal model to set clearing prices in the electricity wholesale market. In times of upheaval in the energy markets, we are at a crossroads. Will solidarity and unity prevail or will we see protectionism governing »strategic« decisions of the EU countries?

Energy prices in the European Union have been soaring for quite some time now. The main driver behind steep growth is historically low levels of natural gas supplies by the Russian government, distressed oil markets, and structural flaws in the EU’s electricity markets. According to data compiled by Eurostat, Russia is the main supplier of crude oil, natural gas, and fossil fuels to the EU. (1) Approximately 40% of the EU’s natural gas imports came from Russia in 2021, followed by imports from Norway of 25%. Similarly, Russia is the leading importer of petroleum oil, accounting for roughly 25% of annual imports. (2) The EU produces only 10% of its annual natural gas consumption. Therefore, the EU imports 90% of the natural gas it consumes, positioning the EU as the largest importer of natural gas in the world. Adding the numbers together we can quickly observe that key principles of diversification were seriously neglected by architects of the EU’s energy strategy.

The EU nations are also battling high electricity prices that are hurting the industry, households and energy companies. As a result, an increasing number of corporations in the chemical industry, paper industry, and metals industry are indicating production shutdown during the upcoming winter months. Energy traders are facing cashflow difficulties when fulfilling margin calls due to steep increases in electricity and natural gas prices. (3) According to Bloomberg, European energy traders might be facing up to EUR 1.5 trillion of margin calls. Hence, governments will be forced to provide vast amounts of liquidity to traders in order to prevent the collapse of the European energy markets. We will most likely see a significant amount of energy companies being nationalised by their governments. Germany’s Uniper is the most notable example.

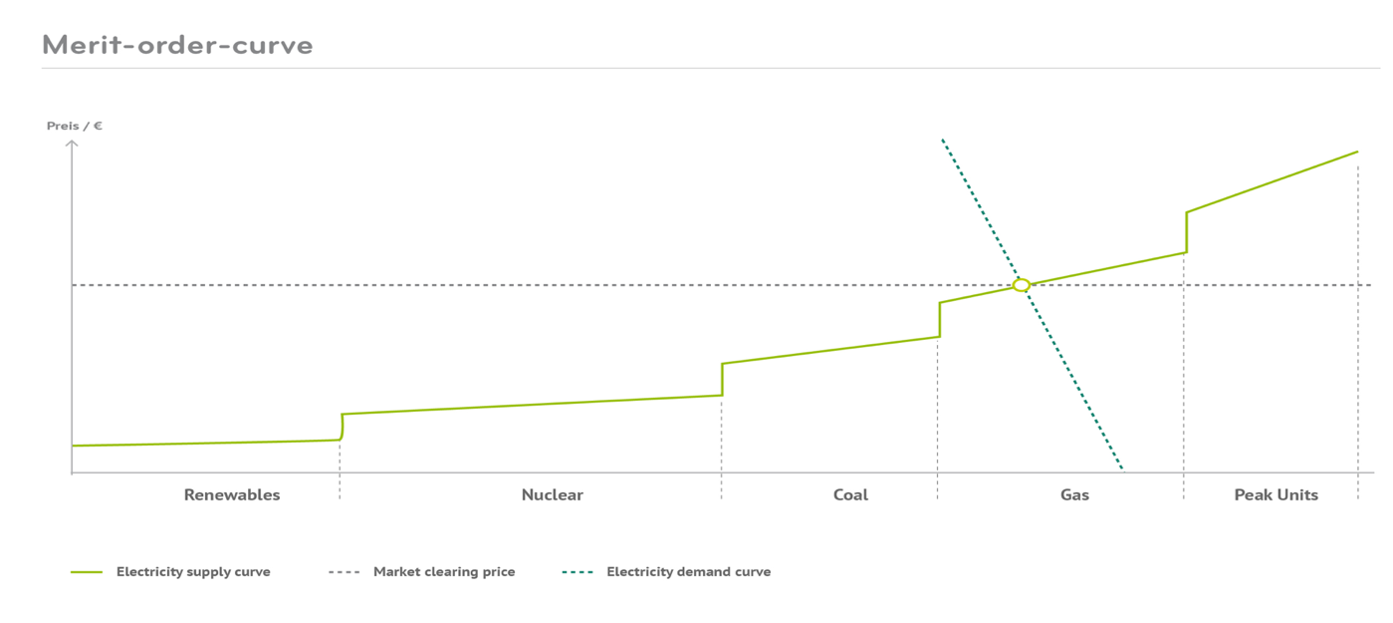

Around 20% of annual electricity output in the EU is produced by using natural gas. Logically, one might ask himself why are electricity prices driven by jumps in natural gas prices. The answer is straightforward – merit order mechanism implemented in European electricity markets. Within this mechanism, prices are first set by electricity producers that have the lowest operating costs – renewable energy. This price is known as the entry price. Then, other energy producers set their prices in order to meet the power demand set by the market. The last producers to set their prices are generally those facilities producing electricity by using natural gas and oil. The last price is known as the clearing price and can be seen in the figure below. This mechanism (in theory) results in pushing expensive and environmentally non-friendly electricity producers more and more out of the market. However, the problem arises if one must meet demand by powering gas turbines in turbulent times like today. By understanding these key principles of how the EU’s electricity markets operate, we can understand why electricity prices and gas prices correlate as much.

Figure 1: Merit order mechanism

Source: Next Kraftwerke

We can only speculate whether the EU will be able to introduce any improvements to the electricity market in the foreseeable future. Nevertheless, we can be certain that natural gas prices will be inflated for quite some time as decades of building reliance on Russia and turning a blind eye to diversification cannot be dealt with effectively or swiftly. The potential impact that the two factors (diversification failure and market structure) could have is unprecedented. The EU might be facing one of the most difficult winters ever. It is uncertain how the tables will turn. It is however certain that they are turning. Hopefully, solidarity and understanding among the EU nations will be followed, which will eventually lead to more diversified and more sustainable energy markets. Unfortunately, one can already observe protectionism patterns in some EU countries, which will complicate matters further.

This article was written by the team at ALPHA CREDO