Overview

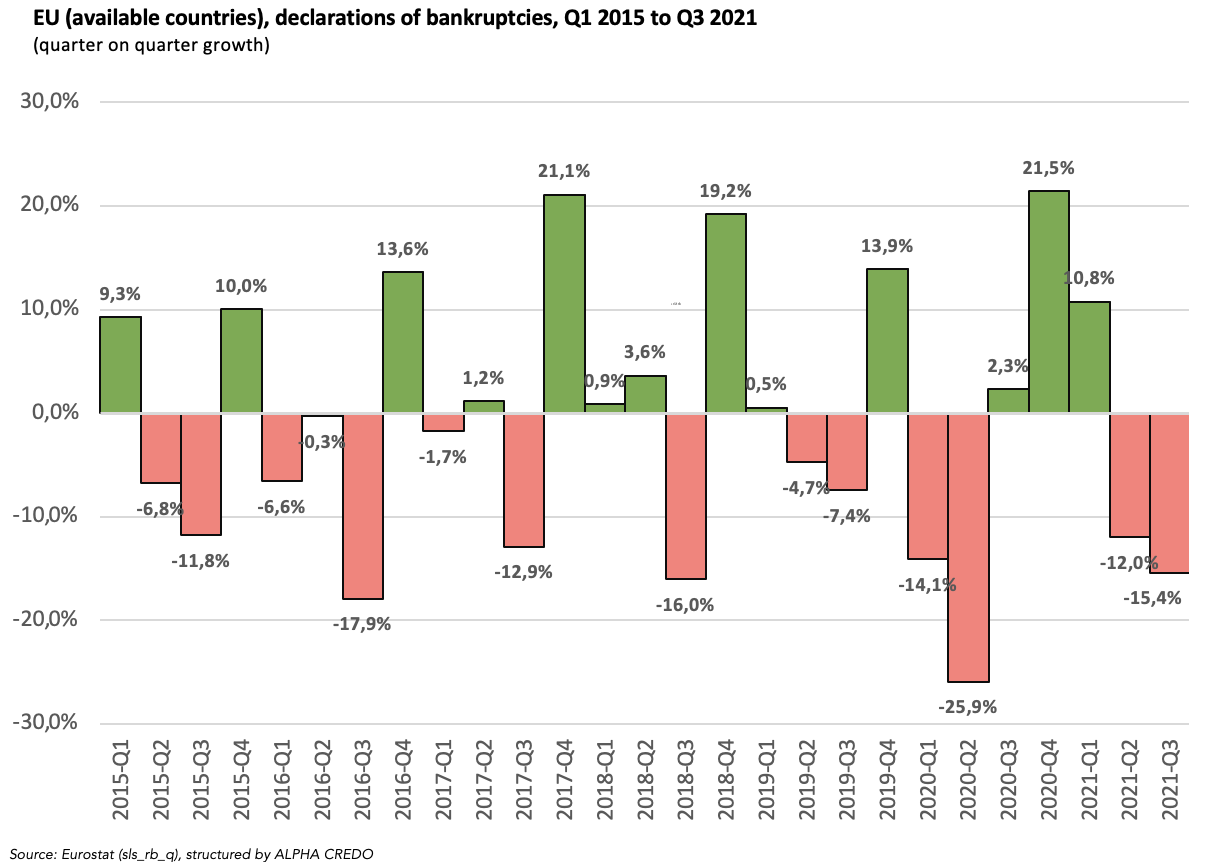

Statistics compiled by Eurostat, the statistical office of the European Union, show that the EU area has quite a volatile quarter on quarter bankruptcy declarations growth. Chart, constructed by ALPHA CREDO, shows that in some quarters, bankruptcy declarations surpassed even a 20% quarter on quarter growth. If we focus on the most recent data, we can see that there had been a huge decline in bankruptcy declarations in the first half of 2020. Such behaviour can be supported by economic policies introduced by governments around the EU to tackle the disruption caused by the COVID-19 pandemic. As a result, less companies filed for bankruptcy than in the quarters before. However, once government support policies expired, bankruptcy declarations grew for three consecutive periods, until the first quarter of 2021. From the beginning of 2021 onwards, bankruptcy declarations recorded yet another decline.

Sector comparison

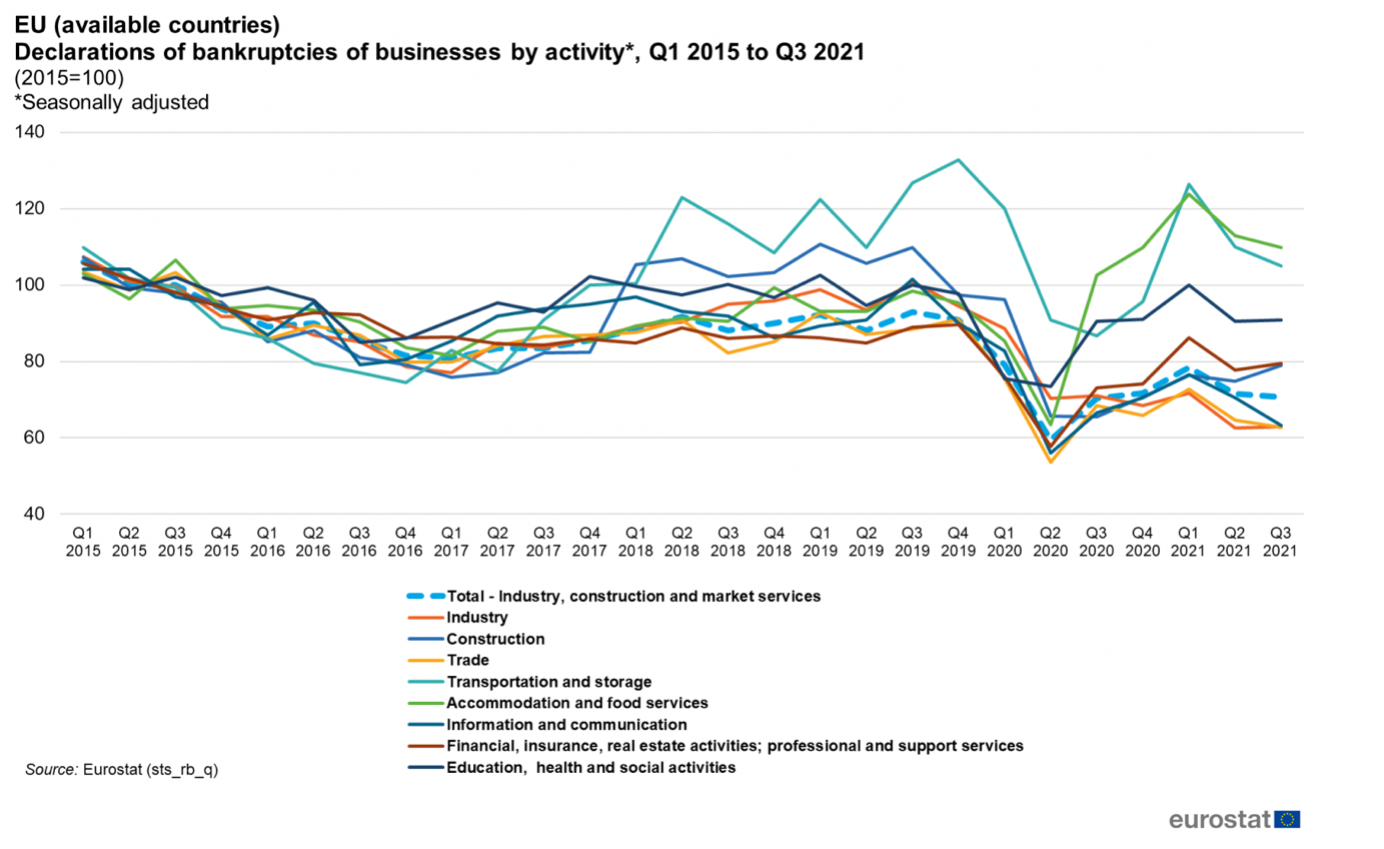

Eurostat data shows that most industries moved in the same bankruptcy declaration pattern. If we observe bankruptcy declarations through various industries from 2018 onward, we can derive that most peaks are linked to the transportation and storage industry, followed by the construction industry. However, if we observe data for the construction industry from the beginning of the pandemic onward, we can quickly see that the construction sector did not follow its typical movement pattern. Interestingly, the construction sector booked bankruptcy declarations levels even below the growth of bankruptcy declarations in the financial services sector which is commonly perceived as one of the most stable and therefore less volatile sectors. Such behaviour can be explained by the government spending programs, which most often use the construction sector as a catalyst for growth of their economies in times of economic difficulties. A similar but reverse behaviour can be observed in the accommodation and food services sector. This sector was steadily following its peers in the period from Q1 2017 to Q3 2019 and recorded an unusual, but intuitive, steep increase in the second period from Q2 2020 to Q1 2021, surpassing its common peers. Moreover, the accommodation and food services sector recorded more insolvency procedures than all other sectors, including the transportation and storage sector, in the third quarter of 2021. Like the construction sector, such behaviour for the accommodation and food services sector was most likely caused by COVID-19 pandemic. Ban on travel, closed restaurants, and work from home policies did put significant pressure on this sector, forcing many business owners to close their businesses, despite expensive government support schemes.

What to expect in the future?

Companies across all sectors in the EU, especially in the industry sector, are still battling the energy crisis. Consequently, numberous companies are facing significant growth of production costs which cannot be easily transferred onto their buyers. As a result, these companies are forced to book (sometis extreme) losses or even shut down their production plants to avoid increasing variable costs. Such developments are putting lots of pressures on liquidity and are therefore questioning the survival of companies without sufficient risk managent. As a result, we expect an increase in bankruptcy declarations across the EU, especially in the industry/production sector. Volatility of quarter on quarter growth of bankruptcies will very likely remain elevated. Another major risk factor, linked to the energy crisis, are current geopolitical tensions between Russia and the West, without any signs of abating.

There is a lot of uncertainty about when the European Central Bank (ECB) will tighten its monetary policy in 2022. Most likely, ECB will follow its peers – the FED and the BOE – in the upcoming months and tighten its monetary policy to fight inflation by cooling down the economy. As a result, we can expect a rise in the reference interest rates. Consequently, highly indebted companies might find themselves on the edge of bankruptcy by not being able to service their debt. Therefore, we could observe more vertical-integration deals in forms of acquisitions, where financially sound companies will be taking over their suppliers to optimise their supply chains which are still heavily disrupted due to the COVID-19 pandemic. On the other hand, we could witness companies acquiring their financially weak competitors. Overall, we are entering yet another period of high uncertainty and in which we expect a growing number of insolvency cases, especially in the industry sector. Monetary tightening record from the past teaches us a strong lesson. Unfortunately, not one to be complacent about.

This article was written by the team at ALPHA CREDO

Sources:

Eurostat (2021): Quarterly registrations of new businesses and declarations of bankruptcies – statistics. Available here*

*Please note that the source page is dynamic. This article is based on statistics available from 17.11.2021. to 17.02.2022. Visiting the source page at a later date may result in different statistics and graphs.