The Eurozone entered a technical recession throughout the winter, according to data compiled by Eurostat. The contraction of 0,1% in the last quarter of 2022 and the first quarter of 2023 is of course negligible. Nevertheless, the contraction indicates that Europe’s economy is cooling down. With persisting inflation, increasing interest rates, and ongoing war at Europe’s doorstep, challenging times are expected for Europe’s policymakers and businesses. Should the economy proceed to contract in such a macroeconomic and geopolitical environment, Europe’s businesses will be faced with challenges and risks that will be difficult to manage and mitigate.

In May, the World Economic Forum (WEF) posted its Chief Economists Outlook where Europe was perceived as the economy with the weakest economic growth in 2023, lagging Sub-Saharan Africa and Latin America. According to leading economists, growth is highly expected in China and Asia in general. Europe’s expected weak growth can be attributed to weak business and consumer sentiment and tightening of financial conditions. Additionally, Europe ranked as the economy where inflation is expected to persist longest. When it comes to interest rate expectations in Europe, economists believe that policymakers will be challenged between taming the inflation and supporting financial stability. Namely, stability of the banking sector is the one which is in question the most. We have seen some bankruptcies in the US where banks were unsuccessfully managing their interest rate risks. As a result, policymakers will most likely slow down the intensity of interest rate increases and by this, struggle to bring inflation to their target rates.

Increasing interest rates and a cooled down economy have already resulted in a jump of insolvencies across Europe. Allianz Trade reports that it expects a 21% increase in its Global Insolvency Index in 2023. Moreover, Allianz Trade expects approximately 59,000 insolvency cases in France (an increase of 41% year-on-year), 28,500 insolvencies in the UK, 17,800 in Germany, and 8,900 of insolvency cases in Italy. At Alpha Credo, we are noticing an increasing number of insolvency cases of small to medium-sized companies across Europe due to rising borrowing costs, price pressures, labour shortage, and poor investment decisions. This goes hand in hand with the data presented by Allianz Trade.

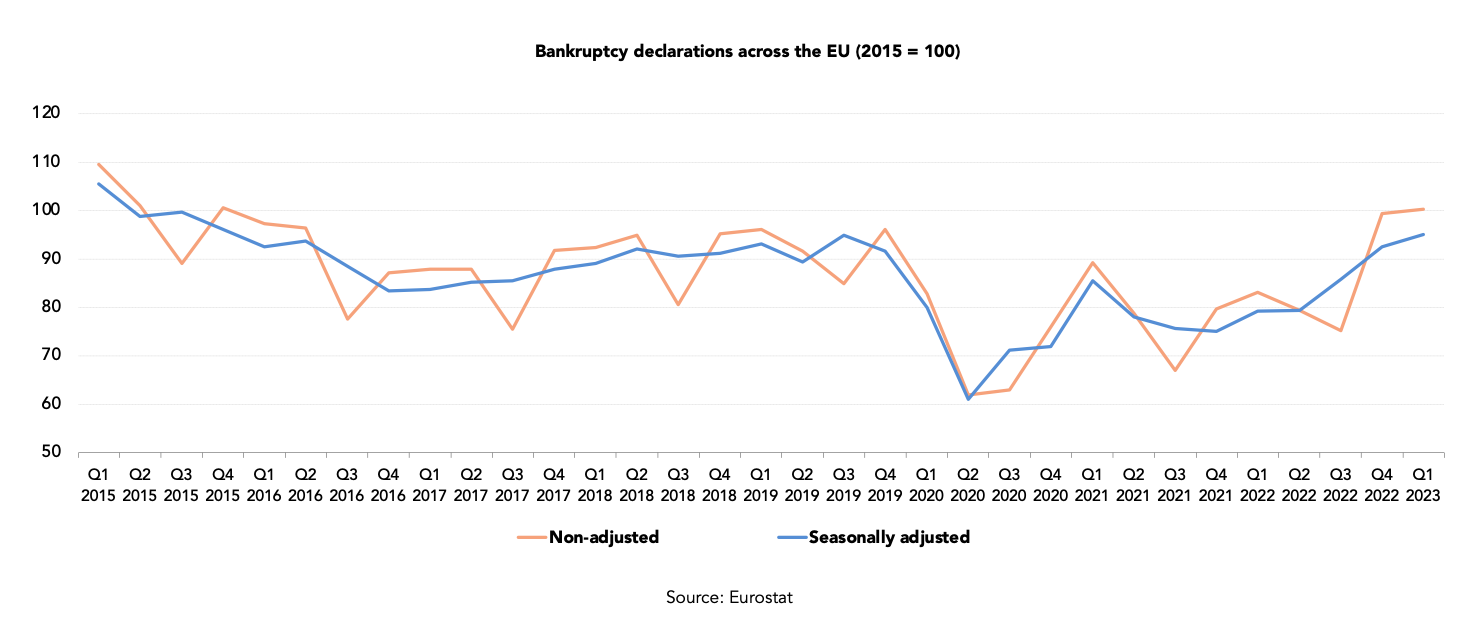

Figures gathered by Eurostat show that bankruptcy declarations are gradually increasing from their lows in 2020. Quarterly registrations of bankruptcy cases have already reached the pre-pandemic levels. Registered bankruptcy cases increased by 2.8% in the first quarter of 2023, compared to the last quarter of 2022. Countries with the highest growth in bankruptcies are Cyprus (+110%), Estonia (+50.2%), and Lithuania (+39.8%). On the other hand, Croatia, Romania, and Luxembourg record a decrease in registered bankruptcy cases compared to the last quarter of 2022. Sector that has seen the largest increase in bankruptcy cases in Europe is the construction sector.

In conclusion, Europe’s economy is anticipated to face turbulent times ahead. The contraction and gradual cooling down of the economy, as evidenced by the available data, raise concerns. The rise in borrowing costs is expected to hinder new investment, further burdening economic growth. Persistent inflation may dampen consumption, presenting an additional obstacle to economic expansion throughout the remainder of 2023. Evolving macroeconomic risks pose increasing challenges to conducting business in Europe. The steep increase in credit risk poses a threat to the balance sheets of suppliers, potentially leading to write-offs. Companies lacking sufficient liquidity, capital buffers, or effective credit risk mitigation tools, such as trade credit insurance, will face the greatest challenges. Currently, insolvency cases primarily affect small and medium-sized enterprises. Spreading this trend to large companies comes with the risk of triggering a domino effect throughout supply chains.

This article was written by the team at ALPHA CREDO

Sources:

Eurostat (2023). Quarterly registrations of new businesses and declarations of bankruptcies – statistics. Retrieved June 13, 2023, from here.

Allianz Trade (2023). No rest for the leveraged. Retrieved June 13, 2023, from here.

World Economic Forum (2023). Chief Economists Outlook: May 2023. Retrieved June 13, 2023, from here.